Thursday, February 25, 2016

The amazing Zatarra Research piece on Wirecard

You can find the report here...

http://zatarra2016.wix.com/zatarra-research

Wirecard has long struck me as suspect - and I have maintained a short for years (yes, literally for years).

I have tried to verify the assets purchased by Wirecard that became corporate goodwill and I could not verify. Indeed I could not even confirm existence of some businesses they purchased.

Generally I follow the advice of Ronald Reagan: trust but verify.

In this case I could not verify Wirecard's assets but I have not verified Zatarra's claims...

So this post links an unverified report of a seemingly unverifiable company...

Even after the down-draft today I am showing decent losses on the position. Not all shorts work out...

John

(Hat-tip to Dan McCrum who has also been sceptical of Wirecard.)

Thursday, February 11, 2016

Valeant - links

http://azvalue.blogspot.com.au/2015/08/valeant-detailed-look-inside-dangerous.html

The second is recent - going through cash needs this year. Valeant will be in acute financial stress at some point this year.

http://seekingalpha.com/instablog/46398186-commsense/4788496-think-know-mike-pearson-feel-well

John

Wednesday, February 3, 2016

Mr Ackman, I forgive you. Mike fooled almost everybody...

I just remember this slide:

It says that Pershing Square's perspective is - and I quote:

- Volume is primary growth driver for ~90% of Valeant’s business

It also states that there will be "no more “price increase” deals and that price increase deals were only four out of approximately 150 historical acquisitions.

Mike Pearson (the CEO of Valeant - now on medical leave at an undisclosed location) has repeatedly supported roughly this view. After all look at the first quarter conference call from last year (transcript here). Mike Pearson is asked specifically about price versus volume. To quote:

Gary Nachman - Goldman Sachs - Analyst

...And then if you could quantify a little bit how much was price versus volume that contributed to growth in 1Q? And what do you factor in your full-year guidance price versus volume?

The response:

J. Michael Pearson - Valeant Pharmaceuticals International Inc - Chairman & CEO

In terms of price volume, actually volume was greater than price in terms of our growth. Outside the United States it's all volume. In fact, we had negative price outside the US with FX. And in the US it's shifting more to volume than price, and we expect that to continue with our launch brands.

A lot of our prices for most of our products are negotiated with managed care. And there's only a limited amount of price that we can take. And then if you look at our consumer business, very little. Walmart doesn't like price increases. If you look at our contact lens business, we're not discounting contact lenses. We are keeping the prices the same. I think there is some noise in the market that there's discounting going on. We're not discounting, but that's all volume growth. And similarly in the cataract surgery market, again, we're just holding our prices. So it's primarily volume, and we expect that to continue.You see everything that Bill Ackman said was consistent with what Mike Pearson was saying.

Alas it is not true!

Today we got an insight into Valeant's price and volume strategy and it categorically demonstrates that Pershing Square's perspective (as quoted above) is false. The source is a summary of Valeant's documents given in response to Congressional subpoenas.

One tartly pertinent quote:

On May 21, 2015, then-Chief Financial Officer Howard Schiller sent an email to Mr. Pearson with the subject “price volume.” He wrote: “Last night, one of the investors asked about price vs volume for Q1. Excluding marathon, price represented about 60% of our growth. If you include marathon, price represents about 80%.”You see Mike Pearson apparently knew that growth was driven by price. If you include Marathon (the Nitropress and Isuprel acquisition) price represented 80 percent of volume. And that was an email from Howard Schiller (current acting CEO) to Mike Pearson (now CEO).

Mike Pearson lied in the conference call. This seems beyond dispute. Just compare the quotes.

Moreover the Congressional documents show that multiple acquisitions have been driven by a pricing strategy. Bill Ackman said that "price increase deals" were a minor part of Valeant's strategy. He has been proven wrong.

I do not think Mr Ackman was deliberately wrong. Mike Pearson misled the world in the first quarter conference call (and in other conference calls). Mr Ackman was wrong because Mike Pearson misled him.

And that is understandable. Mike Pearson convinced many people.

So Bill, you told the world untruths, but they were not deliberate. Mike fooled you.

Love as always,

John

Post script:

Some may ask why I picked on Pershing Square as the victim of Mike Pearson's apparent deceptions. After all Ruane, Cuniff & Goldfarb, T. Rowe Price, ValueAct Capital Management, Viking Global, Paulson & Co. and an ambush of Tiger Cubs are major Valeant holders.

I picked on Pershing Square because of this - a slide in an old Pershing Square presentation:

Pershing Square signed a confidentiality agreement (9 February 2014) and this allowed them to conduct "substantial due diligence" on Valeant. This included:

- extensive management interviews

- a review of parent and regional business plans

- a review of historical and projected organic growth by business unit and region.

We now know that many acquisitions were price driven and growth was driven by pricing but Mr Ackman told us otherwise...

Either

(a) Mr Ackman knew that price not volume was the driver but told us otherwise

or

(b) Mr Ackman thought he was telling the truth when he said that volume, not price was the driver. But he thought that because the company systematically misled him. The deception came not only from Mr Pearson but was repeated throughout "extensive management interviews".

I believe Mr Ackman thought he was telling the truth. (I could be persuaded otherwise but at this time Mr Pearson's credibility is more questionable.)

And if Mr Ackman thought he was telling the truth and he was systematically misled it is pretty obvious what he must do. He must sell his stock. He owns lots of Valeant stock.

If he keeps his stock now he is stating loudly and clearly that it is acceptable for him to invest 30 percent of his clients' money in a company which systematically misled him not just at CEO level but during "extensive management interviews".

Pershing Square surely cares more about the investment process than that.

J

Friday, January 15, 2016

Follow up on Norma Provencio, Valeant and Signalife/Heartronics

We understand that Ms. Provencio participated in a private placement in May 2003 and completely sold her position in 2004. We also understand that Mr. Stein was neither an officer nor director of Signalife during the time period of Ms. Provencio’s investment. According to Mr. Stein’s indictment, his fraudulent activities began in July 2005.The background is that Ms Provencio, the chair of Valeant's audit committee had held the same position at Heartronics/Signalife which has since been exposed as a major fraud and where the principal (Mr Stein) is in prison.

So lets take the defence of Ms Provencio as read.

Valeant seem to accept that Mr Stein's fraudulent activities began in July 2005.

Ms Provencio joined the Heartronics/Signalife board on 29 July 2005.

Her tenure as chair of the audit committee coincided to the month the beginning of outright criminality.

Moreover we know she previously co-invested in Heartronics/Signalife with Mr Stein. To quote and earlier annual report:

On May 15, 2003, we completed the first tranche of a private placement pursuant to which we sold 82,667 units to Mr. Mitchell Stein, SJ Investments and Ms. Norma Provencio at $3 per unit for cash amounting to $248,000. Each unit consisted of one common share and one warrant. Each warrant is exercisable at $3 until May 14, 2004. Upon exercise of the warrants each investor will receive one common share and an additional warrant to purchase one common share $6 per share until November 15, 2004.

Mr. Stein is the spouse of Ms. Tracey Hampton, who owns and controls ARC Finance Group, LLC, which owns approximately 69.6% of our outstanding common shares.

If Ms Provencio does not resign the other board members should resign to protect their reputations and state their disagreement.

PS. And this is worth stating: Ms Provencio can "see no evil". A previous Valeant press release stated:

The only financial reporting matter that Ms. Provencio is specifically aware of that overlapped with her tenure on the Signalife board is a sale in September 2006 of $190,170 that was alleged to have not been a legitimate sale. With respect to that specific matter, the SEC complaint states that it was concealed from that company’s CFO, auditors, outside counsel and other officers.

Hey - there was an indictment that said the criminal activity started in July 2005. There was a trial. There was a conviction.

But according to a Valeant press release Ms Provencio is unaware of any financial reporting matter that overlapped her tenure starting in July 2005.

There is blissfully unaware, there is blind, there is wilfully blind and there is Ms Norma Provencio.

I mean seriously - after an indictment, trial and conviction regarding a company on which she was the chair of the audit committee she is still unaware.

This so strains credibility as to be ridiculous.

J

Sunday, January 10, 2016

Valeant and Norma Provencio: Hmmm...

Mitchell Stein - the key executive at Heartronics/Signalife went to prison. The Valeant press release (repeated in full below) states:

Ms. Provencio has followed the criminal case against Mr. Stein and believes that the matter was handled appropriately.

The same press release also absolves Norma Provencio from a long involvement in the fraud by stating:

With respect to her tenure at Signalife, Ms. Provencio served as a member of the Board of Directors and chair of its Audit Committee from July 2005 to June 2007. She chose not stand for re-election to the board of directors of Signalife.In other words Ms Provencio was not there very long, certainly not involved since inception and she thinks the criminal case was handled appropriately.

Except that Norma Provencio was there from ear inception and was in business with Mitchell Stein from the first involvement I can find from Mitchell Stein. Here is a link for an annual report for Recom Managed Services. That is the company that by reverse merger became Signalife/Heartronics.

And that report makes clear that the original funding for the deals came from Norma Provencio and Mitchell Stein.

On May 15, 2003, we completed the first tranche of a private placement pursuant to which we sold 82,667 units to Mr. Mitchell Stein, SJ Investments and Ms. Norma Provencio at $3 per unit for cash amounting to $248,000. Each unit consisted of one common share and one warrant. Each warrant is exercisable at $3 until May 14, 2004. Upon exercise of the warrants each investor will receive one common share and an additional warrant to purchase one common share $6 per share until November 15, 2004.

Valeant elided that fact in their press release (repeated in full below). Whether Valeant PR elided that fact deliberately matters.

Either

(a) Provencio misled Valeant as to the nature of her involvement with Mitchell Stein, the convicted perpetrator of the Heartronics/Signalife fraud (and Valeant did not knowingly elide the truth in their press release) or

(b) Valeant is actively and deliberately misleading about the time that Ms Provencio was in business with the convicted criminal.

The second is unthinkable. Norma Provencio should resign from the Valeant board.

John Hempton

The Full Valeant release:

The Facts on Norma Provencio’s Tenure as a Director of Valeant Pharmaceuticals

- Bloomberg News has published an article examining Norma Provencio’s tenure on the Board of Directors of Signalife and Valeant. In connection with this inquiry, Valeant provided the following information to Bloomberg News:Ms. Provencio was first elected, as a non-incumbent nominee, to Legacy Valeant’s board in 2007. More than 95% of the votes cast by shareholders with respect to her nomination were cast “for” Ms. Provencio’s election to the Legacy Valeant Board. In nominating Ms. Provencio, the Legacy Valeant Board, thorough its Corporate Governance/Nominating Committee, a customary background check and interview process was conducted.Ms. Provencio was appointed chairperson of the Audit and Risk Committee of VPII (the current company, as surviving company of the 2010 Biovail-Legacy Valeant merger) in 2011. Ms. Provencio served as the Chairperson of the Finance and Audit Committee of VPI from May 2008 until the Biovail merger in September 2010. So, in addition to her accomplished professional background and qualifications, the Board had actual experience working with Ms. Provencio, as a director and as an audit committee chair, and obviously felt comfortable with entrusting her with as the Chairperson of VPII’s Audit and Risk Committee since 2011.Ms. Provencio has many years of financial and industry experience that make her well qualified to serve on Valeant’s Board. Ms. Provencio has been a certified public accountant since 1981 and served as the audit partner on numerous public companies with complex accounting issues during her public accounting career. She has also lead numerous investigations for public and private companies and has been the forensic accountant for numerous special committees during her professional career.The Board has determined that Ms. Provencio’s many years of sophisticated financial and industry specific experience at Provencio Advisory Services, Inc., KPMG LLP and Arthur Andersen, her service on the board and finance and audit committee of VPI, her wealth of knowledge in dealing with financial and accounting matters and the depth and breadth of her exposure to complex financial issues qualify her to be a member of the Board and the committees on which she sits.Ms. Provencio’s directorship with Signalife was disclosed in Valeant’s proxy statement, in compliance with applicable SEC rules. Prior to 2010, the proxy rules required disclosure of then-current public company directorships. Accordingly, Valeant’s 2007 proxy disclosed Ms. Provencio’s directorship with Signalife. Beginning in 2010, the proxy disclosure rules introduced a 5-year look back, and accordingly, Valeant’s proxy statements filed in 2010, 2011, 2012 and 2013 disclosed Ms. Provencio’s previous directorship with Signalife.The ad hoc committee was appointed by the Board of Directors to review allegations related to the company’s business relationship with Philidor and related matters, and consists entirely of independent directors.The votes appointing Ms. Provencio to the ad hoc committee and as chairperson to of the ARC were unanimous. And at each election of directors since Ms. Provencio was appointed to the Legacy Valeant board in 2007, she received the overwhelming support of shareholders as demonstrated by the shareholder vote.Mike Pearson commented, “Since I have known Norma Provencio, she has acted with integrity and displayed sound business judgment, and I believe that she is exceptionally well qualified to lead our Board’s Audit & Risk Committee.”***With respect to her tenure at Signalife, Ms. Provencio served as a member of the Board of Directors and chair of its Audit Committee from July 2005 to June 2007. She chose not stand for re-election to the board of directors of Signalife.The only financial reporting matter that Ms. Provencio is specifically aware of that overlapped with her tenure on the Signalife board is a sale in September 2006 of $190,170 that was alleged to have not been a legitimate sale. With respect to that specific matter, the SEC complaint states that it was concealed from that company’s CFO, auditors, outside counsel and other officers.Signalife engaged outside CPA firms to perform its accounting functions during Ms. Provencio’s tenure on the board. The CPA firms included Robert C. Scherne, CPA, PC and Pickard & Green. Both CPA firms provided accounting and other management consulting services for small companies, including preparing required SEC filings for public companies.Ms. Provencio has followed the criminal case against Mr. Stein and believes that the matter was handled appropriately.

Tuesday, January 5, 2016

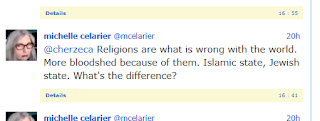

Does News Corp really employ journalists who think there is no difference between the Islamic State and the Jewish State?

I follow her because she is the most anti-Herbalife journalist out there. She also makes up her stories including several details this hit-piece about me.

No more need be said.

John

Post-script: It appears Ms Celarier has been fired from the New York Post. I do not know whether this tweet had anything to do with it - but she has had a total disregard for facts for some time. Her firing is (a) deserved and (b) unsurprising.

J

Monday, December 28, 2015

Friday On My Mind

And I can't help but hum cheery Easybeats songs - which is I think the way it should be.

For those that did not know him - here is Friday On My Mind:

I suspect many more people know the David Bowie cover...

Less well known is Bruce Springsteen's penchant for covering the Easybeats, however The Boss makes it an angry song and it shouldn't be like that.

John

Thursday, December 17, 2015

Valeant: cash EPS, GAAP EPS and various covenants

Lets just take the 3Q guidance as published:

Q4 2015 Revised Guidance

- Total Revenues previously $3.25 - $3.45 billion now $2.7 - $2.8 billion

- Adjusted EPS* previously $4.00 - $4.20 now $2.55 -$2.65

- Adjusted Cash Flow from Operations* previously greater than $1.0 billion, now greater than $600 million

At the low end of this range we have reduced quarterly revenue from $3.25 billion to $2.8 billion dollars. This is $425 million. [The high-end of the reduction is $750 million.]

The reduction is - at this end - $425 million on $3.25 billion of sales. The low end is thus a 13 percent revenue reduction.

Here is what Valeant said about Philidor on the October 26 call.

To quote: In Q3 2015, Philidor represented 6.8% of total Valeant revenue.

The reduction in revenue is about twice the revenue running through Philidor.

Observation 1: The revenue drop is more than just Philidor. Something else is going on.

The bull argument to date is that Philidor is a small percentage of sales some of which will be caught elsewhere and thus can be ignored. However the drop in sales is twice Philidor (or more than twice Philidor for most points in the range).

Second - the "adjusted EPS* drops from $4.00 - $4.20 to $2.55 -$2.65. This is a drop at the minimum end of $4.00 to $2.65 0r $1.35 per share.

There were - according to the last 10Q - 343,101,797 shares outstanding as of October 19, 2015.

The fall in cash-EPS is more than double the entire revenue of Philidor.

Again something other than Philidor has been broken here.

GAAP numbers and debt covenants

Valeant tells the market about "cash EPS" - a measure that differs considerably from GAAP EPS.

The cash EPS numbers are not audited. The differences are differences you must trust the management to honestly report.

However they are not the numbers as reported in the 10-Q nor are they the numbers that are contained in the debt covenants. [See just one debt indenture at this link.]

Here is the P&L statement for the last quarter and nine months from the 10-Q.

Three Months Ended

September 30, |

Nine Months Ended

September 30, | ||||||||||||||

2015

|

2014

|

2015

|

2014

| ||||||||||||

Revenues

| |||||||||||||||

Product sales

|

$

|

2,748.2

|

$

|

2,022.9

|

$

|

7,590.1

|

$

|

5,868.1

| |||||||

Other revenues

|

38.6

|

33.3

|

120.0

|

115.4

| |||||||||||

2,786.8

|

2,056.2

|

7,710.1

|

5,983.5

| ||||||||||||

Expenses

| |||||||||||||||

Cost of goods sold (exclusive of amortization and impairments of

| |||||||||||||||

finite-lived intangible assets shown separately below)

|

634.6

|

545.8

|

1,864.9

|

1,619.5

| |||||||||||

Cost of other revenues

|

13.6

|

15.0

|

43.1

|

45.3

| |||||||||||

Selling, general and administrative

|

697.6

|

504.1

|

1,956.9

|

1,501.8

| |||||||||||

Research and development

|

101.6

|

59.1

|

238.5

|

186.9

| |||||||||||

Amortization and impairments of finite-lived intangible assets

|

679.2

|

393.1

|

1,629.8

|

1,113.9

| |||||||||||

Restructuring, integration and other costs

|

75.6

|

61.7

|

274.0

|

337.4

| |||||||||||

In-process research and development impairments and other charges

|

95.8

|

19.9

|

108.1

|

40.3

| |||||||||||

Acquisition-related costs

|

7.0

|

1.6

|

26.3

|

3.7

| |||||||||||

Acquisition-related contingent consideration

|

3.8

|

4.0

|

22.6

|

14.8

| |||||||||||

Other expense (income)

|

30.2

|

(232.0

|

)

|

213.2

|

(275.7

|

)

| |||||||||

2,339.0

|

1,372.3

|

6,377.4

|

4,587.9

| ||||||||||||

Operating income

|

447.8

|

683.9

|

1,332.7

|

1,395.6

| |||||||||||

Interest income

|

0.7

|

0.8

|

2.5

|

3.8

| |||||||||||

Interest expense

|

(420.2

|

)

|

(258.4

|

)

|

(1,130.7

|

)

|

(746.1

|

)

| |||||||

Loss on extinguishment of debt

|

—

|

—

|

(20.0

|

)

|

(93.7

|

)

| |||||||||

Foreign exchange and other

|

(34.0

|

)

|

(53.0

|

)

|

(99.5

|

)

|

(63.0

|

)

| |||||||

Gain on investments, net

|

—

|

3.4

|

—

|

5.9

| |||||||||||

(Loss) income before (recovery of) provision for income taxes

|

(5.7

|

)

|

376.7

|

85.0

|

502.5

| ||||||||||

(Recovery of) provision for income taxes

|

(57.4

|

)

|

100.3

|

10.4

|

124.4

| ||||||||||

Net income

|

51.7

|

276.4

|

74.6

|

378.1

| |||||||||||

Less: Net income (loss) attributable to noncontrolling interest

|

2.2

|

1.0

|

4.4

|

(0.5

|

)

| ||||||||||

Net income attributable to Valeant Pharmaceuticals International, Inc.

|

$

|

49.5

|

$

|

275.4

|

$

|

70.2

|

$

|

378.6

| |||||||

Earnings per share attributable to Valeant Pharmaceuticals International, Inc.:

| |||||||||||||||

Basic

|

$

|

0.14

|

$

|

0.82

|

$

|

0.21

|

$

|

1.13

| |||||||

Diluted

|

$

|

0.14

|

$

|

0.81

|

$

|

0.20

|

$

|

1.11

| |||||||

Weighted-average common shares (in millions)

| |||||||||||||||

Basic

|

344.9

|

335.4

|

340.8

|

335.2

| |||||||||||

Diluted

|

351.0

|

341.3

|

347.2

|

341.4

| |||||||||||

Note that operating income (earnings before interest and tax) for the third quarter was $447.8 million and for the nine months was $1332.7 million.

Note that the minimum fall in so-called "cash eps" in the fourth quarter is larger than the entirety of operating income in the third quarter. This should provide some scale.

Here is the cash flow statement from the last 10-Q.

Three Months Ended

September 30, |

Nine Months Ended

September 30, | ||||||||||||||

2015

|

2014

|

2015

|

2014

| ||||||||||||

Cash Flows From Operating Activities

| |||||||||||||||

Net income

|

$

|

51.7

|

$

|

276.4

|

$

|

74.6

|

$

|

378.1

| |||||||

Adjustments to reconcile net loss (income) to net cash provided by operating activities:

| |||||||||||||||

Depreciation and amortization, including impairments of finite-lived intangible assets

|

726.4

|

439.3

|

1,768.4

|

1,248.1

| |||||||||||

Amortization and write-off of debt discounts and debt issuance costs

|

20.5

|

34.6

|

123.7

|

58.1

| |||||||||||

In-process research and development impairments

|

95.8

|

19.9

|

108.1

|

20.3

| |||||||||||

Acquisition accounting adjustment on inventory sold

|

27.2

|

12.4

|

97.7

|

21.9

| |||||||||||

Loss (gain) on disposal of assets, net

|

5.3

|

(254.5

|

)

|

9.2

|

(254.5

|

)

| |||||||||

Acquisition-related contingent consideration

|

3.8

|

4.0

|

22.6

|

14.8

| |||||||||||

Allowances for losses on accounts receivable and inventories

|

19.6

|

12.0

|

46.4

|

47.6

| |||||||||||

Deferred income taxes

|

(91.4

|

)

|

74.6

|

(79.0

|

)

|

63.2

| |||||||||

Additions (reductions) to accrued legal settlements

|

25.6

|

(0.9

|

)

|

31.9

|

(48.2

|

)

| |||||||||

Payments of accrued legal settlements

|

(26.2

|

)

|

(0.2

|

)

|

(32.1

|

)

|

(1.2

|

)

| |||||||

Share-based compensation

|

50.5

|

20.2

|

111.4

|

60.6

| |||||||||||

Excess tax expense (benefits) from share-based compensation

|

3.9

|

(15.9

|

)

|

(21.7

|

)

|

(17.1

|

)

| ||||||||

Foreign exchange loss

|

31.0

|

55.1

|

96.6

|

62.4

| |||||||||||

Loss on extinguishment of debt

|

—

|

—

|

20.0

|

93.7

| |||||||||||

Payment of accreted interest on contingent consideration

|

(7.7

|

)

|

(1.3

|

)

|

(19.8

|

)

|

(9.5

|

)

| |||||||

Other

|

0.2

|

9.7

|

(13.7

|

)

|

15.8

| ||||||||||

Changes in operating assets and liabilities:

| |||||||||||||||

Trade receivables

|

(347.2

|

)

|

(121.4

|

)

|

(656.0

|

)

|

(205.2

|

)

| |||||||

Inventories

|

(45.6

|

)

|

(41.5

|

)

|

(132.4

|

)

|

(122.8

|

)

| |||||||

Prepaid expenses and other current assets

|

(88.5

|

)

|

5.5

|

(252.0

|

)

|

34.5

| |||||||||

Accounts payable, accrued and other liabilities

|

281.6

|

90.7

|

334.1

|

18.4

| |||||||||||

Net cash provided by operating activities

|

736.5

|

618.7

|

1,638.0

|

1,479.0

| |||||||||||

Cash Flows From Investing Activities

| |||||||||||||||

Acquisition of businesses, net of cash acquired

|

(115.8

|

)

|

(606.8

|

)

|

(14,001.7

|

)

|

(981.1

|

)

| |||||||

Acquisition of intangible assets and other assets

|

(0.1

|

)

|

(74.3

|

)

|

(58.1

|

)

|

(105.8

|

)

| |||||||

Purchases of property, plant and equipment

|

(51.1

|

)

|

(39.6

|

)

|

(163.7

|

)

|

(211.2

|

)

| |||||||

Proceeds from sales and maturities of short-term investments

|

32.5

|

—

|

50.2

|

—

| |||||||||||

Net settlement of assumed derivative contracts (Note 3)

|

—

|

—

|

184.6

|

—

| |||||||||||

Settlement of foreign currency forward exchange contracts

|

—

|

—

|

(26.3

|

)

|

—

| ||||||||||

Purchases of marketable securities

|

(24.2

|

)

|

—

|

(24.5

|

)

|

—

| |||||||||

Purchase of equity method investment

|

—

|

—

|

—

|

(75.9

|

)

| ||||||||||

Proceeds from sale of assets and businesses, net of costs to sell

|

2.5

|

1,477.0

|

2.8

|

1,479.8

| |||||||||||

Decrease (increase) in restricted cash and cash equivalents

|

—

|

—

|

(5.2

|

)

|

—

| ||||||||||

Net cash (used in) provided by investing activities

|

(156.2

|

)

|

756.3

|

(14,041.9

|

)

|

105.8

| |||||||||

Cash Flows From Financing Activities

| |||||||||||||||

Issuance of long-term debt, net of discount

|

—

|

555.0

|

16,925.8

|

963.4

| |||||||||||

Repayments of long-term debt

|

(29.0

|

)

|

(1,629.8

|

)

|

(1,387.2

|

)

|

(2,184.0

|

)

| |||||||

Repayments of convertible notes assumed

|

—

|

—

|

(3,122.8

|

)

|

—

| ||||||||||

Issuance of common stock, net

|

—

|

—

|

1,433.7

|

—

| |||||||||||

Repurchases of common shares

|

—

|

—

|

(50.0

|

)

|

—

| ||||||||||

Proceeds from exercise of stock options

|

7.0

|

3.8

|

29.1

|

10.9

| |||||||||||

Excess tax benefits from share-based compensation

|

(3.9

|

)

|

15.9

|

21.7

|

17.1

| ||||||||||

Payment of employee withholding tax upon vesting of share-based awards

|

(24.3

|

)

|

(2.0

|

)

|

(85.8

|

)

|

(38.5

|

)

| |||||||

Payments of contingent consideration

|

(48.4

|

)

|

(14.4

|

)

|

(129.4

|

)

|

(96.6

|

)

| |||||||

Payments of financing costs

|

—

|

(10.2

|

)

|

(101.7

|

)

|

(18.8

|

)

| ||||||||

Other

|

(9.9

|

)

|

(0.4

|

)

|

(10.2

|

)

|

(14.9

|

)

| |||||||

Net cash (used in) provided by financing activities

|

(108.5

|

)

|

(1,082.1

|

)

|

13,523.2

|

(1,361.4

|

)

| ||||||||

Effect of exchange rate changes on cash and cash equivalents

|

(9.8

|

)

|

(15.3

|

)

|

(21.9

|

)

|

(14.9

|

)

| |||||||

Net increase in cash and cash equivalents

|

462.0

|

277.6

|

1,097.4

|

208.5

| |||||||||||

Cash and cash equivalents, beginning of period

|

958.0

|

531.2

|

322.6

|

600.3

| |||||||||||

Cash and cash equivalents, end of period

|

$

|

1,420.0

|

$

|

808.8

|

$

|

1,420.0

|

$

|

808.8

| |||||||

Non-Cash Investing and Financing Activities

| |||||||||||||||

Acquisition of businesses, contingent and deferred consideration obligations at fair value

|

$

|

(108.7

|

)

|

$

|

(16.0

|

)

|

$

|

(783.3

|

)

|

$

|

(65.1

|

)

| |||

Acquisition of businesses, debt assumed

|

(6.1

|

)

|

(4.5

|

)

|

(3,129.2

|

)

|

(8.5

|

)

| |||||||

Depreciation and amortization, including impairments of finite-lived intangible assets was $726.4 million in the third quarter and $1,768.4 for the nine months.

In the third quarter EBITDA (defined as earnings before interest and tax and adding in depreciation and amortisation) was $447.8 + $726.4 million = $1174 million.

So so-called cash EPS will fall by roughly $463 million at a minimum.

This means that the run-rate GAAP EBITDA is $711 million or less.

Debt restrictions

Here is a debt indenture. This debt indenture places restrictions on Valeant if the debt to EBITDA ratio exceed 3.5 times. These do not cause an "event of default" but do limit Valeant's flexibility to buy back shares (they can't), incur most indebtedness or to make other investments.

Given that debt is about $30 billion and EBITDA run-rate is about $700 million per quarter there can be little question that Valeant is operating under strict loan-covenant based restrictions.

In Pearson we trust

Mike Pearson did not tell us about Philidor.

Originally Valeant stated that they did not disclose Philidor because their alternative fulfilment was a "competitive advantage". Later they declared that Philidor was not unusual - other companies used specialty pharmacies (p. 8).

Then Mike Pearson told us that the issues related to Philidor and Philidor was 6.8 percent of revenue.

Then he guided down revenue by approximately double the sales of Philidor.

Then he neglected to tell the market he was operating under covenants that restrict many of his actions. In October Bill Ackman thought that Valeant might buy-back stock at these low prices. That is not possible.

Still despite these things it is clear that most the market believes something akin to Valeant's so-called cash EPS.

The market trusts Mr Pearson for the moment.

I am a gnarly fellow however: I note the revenue fall is roughly twice Philidor - so I know that I don't know what is going on and I don't believe what I am told.

What you believe dear readers however is up to you.

John

General disclaimer

The content contained in this blog represents the opinions of Mr. Hempton. You should assume Mr. Hempton and his affiliates have positions in the securities discussed in this blog, and such beneficial ownership can create a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance and are subject to certain risks, uncertainties and other factors. Certain information in this blog concerning economic trends and performance is based on or derived from information provided by third-party sources. Mr. Hempton does not guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Such information may change after it is posted and Mr. Hempton is not obligated to, and may not, update it. The commentary in this blog in no way constitutes a solicitation of business, an offer of a security or a solicitation to purchase a security, or investment advice. In fact, it should not be relied upon in making investment decisions, ever. It is intended solely for the entertainment of the reader, and the author. In particular this blog is not directed for investment purposes at US Persons.